Ever had your dream vacation derailed by a hurricane, snowstorm, or even an unexpected heatwave? Yeah, it sucks. A canceled flight or delayed itinerary can turn paradise into purgatory faster than you can say, “Where’s my sunscreen?” If only there were some way to protect yourself from Mother Nature’s mood swings… Oh wait—there is! Enter weather insurance, one of the least-talked-about gems in travel planning. But how do you know which policies are worth their salt? Stick around as we dive deep into Weather Insurance Reviews and explore everything you need to know about this underappreciated microniche.

In this guide, you’ll learn:

- The biggest pains weather-related delays cause travelers (and why they matter).

- How to choose the best weather insurance policy for your needs.

- Tips and tricks to maximize coverage without overpaying.

Table of Contents

- Key Takeaways

- Why Weather Delays Are More Than Just Annoying

- How to Pick the Right Weather Insurance Policy

- Pro Tips for Maximizing Your Coverage

- Case Study: Real-Life Success Story

- FAQs on Weather Insurance Reviews

Key Takeaways

- Weather delays affect up to 30% of all flights annually—a risk no traveler can afford to ignore.

- Not all weather insurance policies are created equal; look for specifics like “named storm” clauses.

- Premiums vary wildly based on coverage limits, so shop smartly to avoid overspending.

Why Weather Delays Are More Than Just Annoying

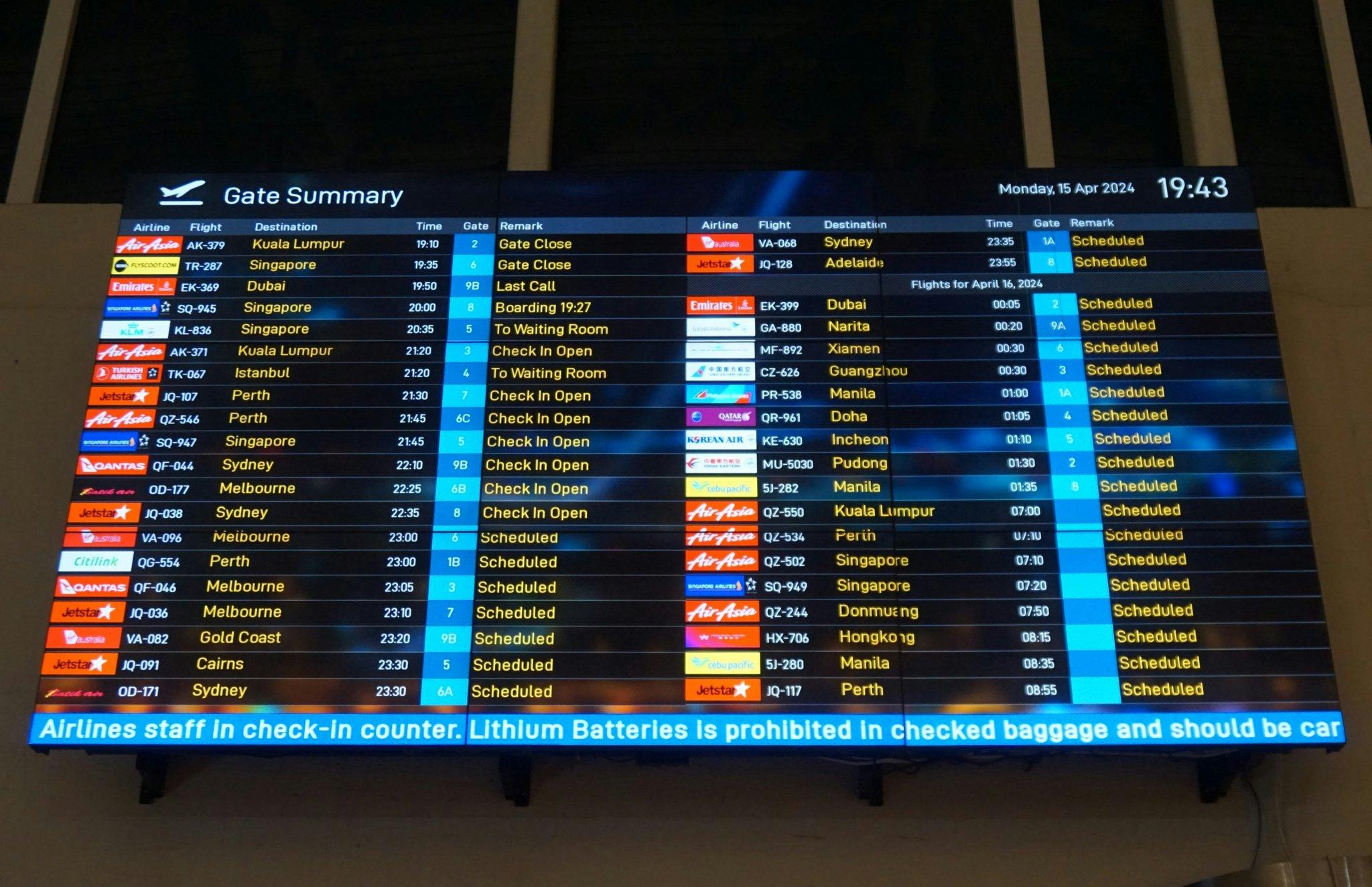

Let me paint you a picture: You’ve just boarded your plane after saving up months for that once-in-a-lifetime trip to Bali. The engines rev up—but then silence strikes. Why? Because Hurricane Helga decided she didn’t get invited. Now you’re stuck at Gate C7, staring wistfully out the window while Instagrammers post sunsets from the beach you should be lounging on.

Optimist You: “It happens. At least I’ll reschedule!”

Grumpy Me: “Yeah, and spend hours arguing with customer service reps who act like robots.”

If only someone had told future-you to invest in travel delay insurance. While many think these policies are only for medical emergencies, they often cover weather-related disruptions too. And if you don’t believe me… well, let’s just say ignorance isn’t bliss when you’re footing a $1,200 hotel bill because your connecting flight got grounded due to fog.

How to Pick the Right Weather Insurance Policy

What Should You Look For?

- Named Storm Clauses: Some policies specify payout conditions tied to officially declared storms. Make sure yours does!

- Coverage Limits: Will your insurer pay for accommodation, meals, and alternate transportation? Read the fine print.

- Claims Process: Easy-to-navigate claims systems make life infinitely easier when disaster strikes.

Avoid This Terrible Tip:

Don’t fall for insurers advertising super-cheap premiums without digging deeper. Sometimes those “bargain” prices exclude essential perks like meal reimbursement or extended stay benefits. Always prioritize value over vanity pricing!

Rant Alert!

Okay, quick rant here: Can we talk about how confusing insurance jargon is?! Companies throw around terms like “exclusions” and “endorsements,” expecting us to decipher them like secret codes. Newsflash: Most people aren’t lawyers! If you want loyal customers, write clear contract language instead of making us feel dumb.

Pro Tips for Maximizing Your Coverage

Tip #1: Book Early

Many providers offer lower rates if purchased shortly after booking your tickets. Timing matters.

Tip #2: Bundle Smartly

Some companies bundle travel medical and baggage insurance alongside weather protection. Double-check whether bundling saves money.

Tip #3: Check Existing Plans First

Before buying separate coverage, review existing plans through credit cards or employer programs—they might already include weather protection.

Case Study: Real-Life Success Story

Meet Sarah from Dallas, TX. She invested in a comprehensive plan before her honeymoon to Fiji last summer. When Cyclone Winston hit midway through her journey, Sarah’s insurer covered not only her unplanned five-day stay in Auckland but also provided daily meal allowances and alternative transport back home. Total payout? Over $3,500—more than enough to salvage her vacation experience.

Sarah says, “I wouldn’t have known what to do otherwise. Knowing I was protected gave me peace of mind.” Chef’s kiss for preparedness!

FAQs on Weather Insurance Reviews

Q1: Does Every Travel Insurance Policy Cover Bad Weather?

Nope. Many basic plans exclude natural disasters unless explicitly stated. Always verify coverage details.

Q2: How Quickly Do Claims Get Paid?

Reimbursement varies by provider, but most aim to process within 14–30 days post-submission of required documents.

Q3: Is Weather Insurance Worth It?

Depends on where you’re headed and when. Destinations prone to seasonal extremes (e.g., Caribbean in hurricane season) make it a wise investment.

Conclusion

Let’s recap: Weather delays stink, but weather insurance reviews reveal affordable ways to combat uncertainty. By choosing wisely, following pro tips, and avoiding rookie mistakes, you can protect yourself against nature’s unpredictability without breaking the bank.

Final thought? Like a Tamagotchi, your travel plans need constant nurturing—and insurance is part of that care routine. Stay safe out there!