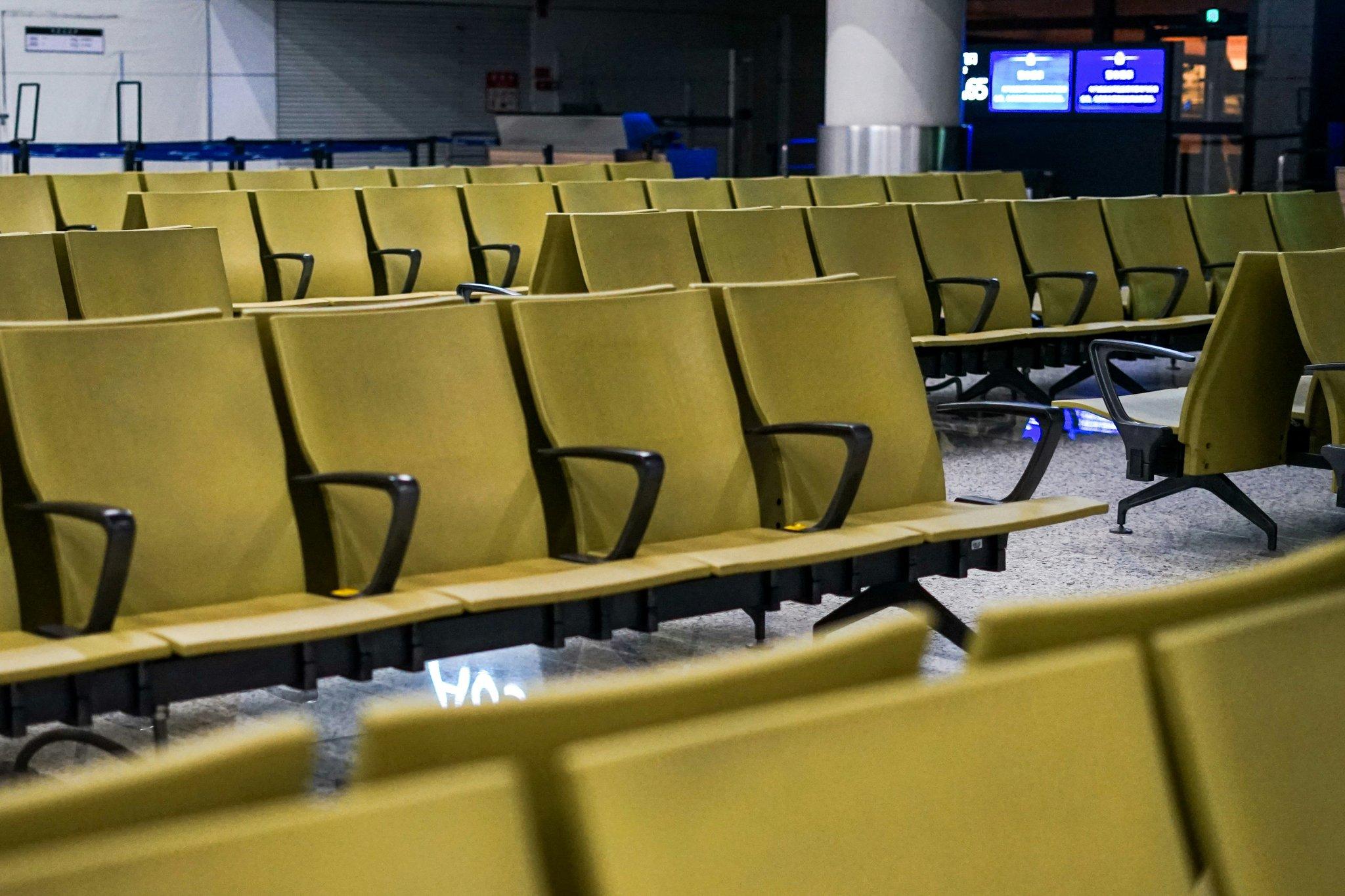

Ever been stuck at an airport for 12 hours with a delayed flight and no backup plan? Yeah, we’ve all been there. A missed connection, canceled flights, or unexpected weather can turn your dream vacation into a logistical nightmare (and a financial one too). But what if you could protect yourself against these stressors?

In this guide, we’ll break down everything you need to know about Itinerary Insurance Reviews, focusing specifically on travel delay insurance—what it is, how to choose the right policy, tips from experts, real-life examples, and yes, even the occasional rant. Let’s dive in!

Table of Contents

- Key Takeaways

- Why Travel Delay Insurance Matters

- How to Find the Perfect Policy

- Top Tips for Comparing Plans

- Real-World Examples and Case Studies

- FAQ About Itinerary Insurance Reviews

- Conclusion

Key Takeaways

- Travel delay insurance protects you financially when your trip doesn’t go as planned.

- Reading Itinerary Insurance Reviews helps compare policies effectively.

- The best plans cover delays over 6 hours, include meal allowances, and provide hotel accommodations.

- Avoid common pitfalls like opting for overly cheap coverage that lacks essential benefits.

- Always check exclusions before purchasing any policy.

Why Travel Delay Insurance Matters

Picture this: You’re flying to Paris for your honeymoon, but due to unforeseen technical issues, your connecting flight gets delayed by eight hours. Now you’re stranded in a foreign country without cash, food, or access to hotels. This isn’t just inconvenient—it’s costly. Enter travel delay insurance.

I once underestimated the importance of this exact type of coverage during a ski trip in Canada. The airline offered $0 compensation after our layover turned into a full-day ordeal at the gate. Lesson learned—the hard way. And trust me, nothing screams “grumpy traveler” more than realizing your wallet took the biggest hit.

Optimist You:

“It won’t happen to me!”

Grumpy You:

“Oh yeah? Tell that to the thousands who face delays every year.”

How to Find the Perfect Policy

Finding a good travel delay insurance plan doesn’t have to feel like solving a Rubik’s Cube blindfolded. Here are some actionable steps:

- Research Top Providers: Start by reading comprehensive Itinerary Insurance Reviews. Look for providers known for their robust customer service and clear terms.

- Understand What’s Covered: Policies vary widely; some may only kick in after a 12-hour delay, while others start compensating after six hours.

- Compare Quotes: Use comparison websites to get quotes side-by-side. Don’t fall for low prices alone; examine the fine print.

- Check Exclusions Carefully: Most policies exclude things like strikes or pre-existing medical conditions unless explicitly stated otherwise.

Top Tips for Comparing Plans

Not all travel delay insurances are created equal. Here are my expert-approved tips:

- Go Beyond Price: Yes, budget constraints matter, but remember: the cheapest option often means hidden costs later.

- Read Customer Reviews: Real experiences shared online reveal whether claims were processed smoothly.

- Look for Comprehensive Benefits: Meals, accommodations, transportation—all should ideally be included.

Pro Tip:

Some policies also refund unused portions of non-refundable bookings. Chef’s kiss for drowning out extra expenses.

Terrible Tip Warning:

Assuming “standard” travel insurance covers all types of delays. Spoiler alert: it doesn’t. Always read the small print.

Real-World Examples and Case Studies

Consider Sarah T., a busy entrepreneur whose business trip to Tokyo got derailed thanks to Typhoon Hagibis. Her travel delay insurance not only covered her additional hotel stay but also reimbursed meals totaling $150. She credits her peace of mind entirely to thorough research via detailed Itinerary Insurance Reviews.

FAQ About Itinerary Insurance Reviews

Q: Does Standard Travel Insurance Include Travel Delay Coverage?

Nope. Many base-level packages exclude delays altogether. Be sure to double-check.

Q: Can I File Claims Retroactively If My Flight Was Delayed Before Buying Insurance?

Unfortunately, no. Insurance always needs to be purchased beforehand.

Q: How Long Do Payments Usually Take To Process Once Claim Is Filed?

Varies per provider, though reputable ones typically process within 14 days.

Conclusion

Navigating the world of travel delay insurance might seem daunting initially, but armed with resources like Itinerary Insurance Reviews, solid strategies, and insider knowledge, you’re well-equipped to make informed decisions.

Remember: preparation beats panic every time. Bon voyage—and here’s hoping smooth travels always come your way!

P.S. Like trying to revive a Tamagotchi post-vacation, good choices today ensure future happiness tomorrow.